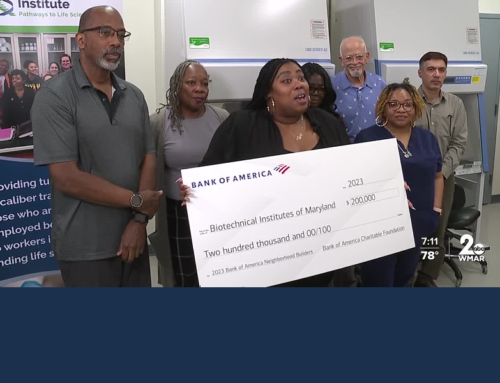

BTI has qualified to issue tax credits to residents and businesses that contribute to our work.

The Community Investment Tax Credit (CITC) program of the Maryland Department of Housing and Community Development promotes community partnership by providing state tax credits to businesses and individuals who contribute to nonprofit organizations that address critical needs in the community. BTI has qualified to issue these credits to residents and businesses that contribute to our work helping unemployed and underemployed students in Baltimore launch professional careers with life sciences employers.

Any donation you make of $500 or more will qualify you to receive a tax credit equal to 50 percent of the value of the donation. These tax credits may be claimed in addition to standard state and federal deductions for charitable contributions.

Donors simply complete a short state required waiver form to ensure eligibility. For questions or more information on this timely incentive to support our work contact us here: Leslie Prewitt, lprewitt@biotechmd.org or call her at 410752-4224.